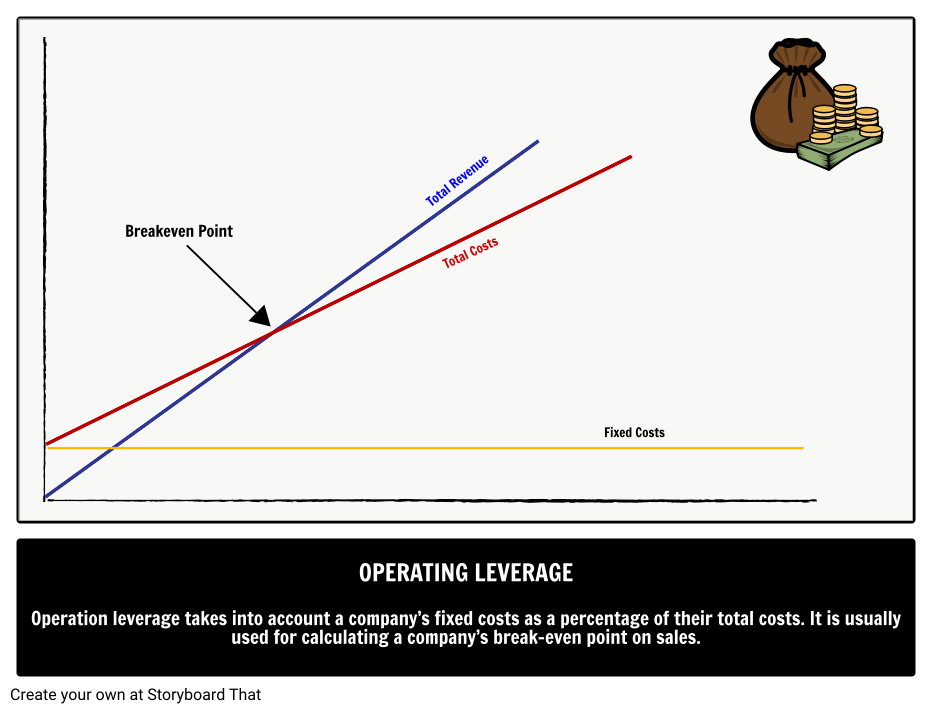

Consider, for instance, fixed and variable costs, which are critical inputs for understanding operating leverage. It would be surprising if companies didn’t have this kind of information on cost structure, but companies are not required to disclose such information in published accounts. Companies with high operating leverage can make more money from each additional sale if they don’t have to increase costs to produce more sales. The minute business picks up, fixed assets such as property, plant and equipment (PP&E), as well as existing workers, can do a whole lot more without adding additional expenses. Under all three cases, the contribution margin remains constant at 90% because the variable costs increase (and decrease) based on the change in the units sold.

What is your risk tolerance?

On that note, the formula is thereby measuring the sensitivity of a company’s operating income based on the change in revenue (“top-line”). In practice, the formula most often used to calculate operating leverage tends to be dividing the change in operating income by the change in revenue. As a company generates revenue, operating leverage is among the most influential factors that determine how much of that incremental revenue actually trickles down to operating income (i.e. profit). Since profits increase with volume, returns tend to be higher if volume is increased. The challenge that this type of business structure presents is that it also means that there will be serious declines in earnings if sales fall off.

What if a company’s operating leverage is less than 1?

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to how to enter or overwrite form 4562 millions of readers each year. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

Operating Leverage Calculator

A larger proportion of variable costs, on the other hand, will generate a low operating leverage ratio and the firm will generate a smaller profit from each incremental sale. In other words, high fixed costs means a higher leverage ratio that turn into higher profits as sales increase. This is the financial use of the ratio, but it can be extended to managerial decision-making. The Degree of Operating Leverage (DOL) is a financial metric that measures how a company’s operating income (EBIT) responds to changes in sales volume.

- By contrast, a retailer such as Walmart demonstrates relatively low operating leverage.

- Financial leverage relates to Operating Leverage, which uses fixed costs to measure risk, by adding market volatility into the equation.

- From Year 1 to Year 5, the operating margin of our example company fell from 40.0% to a mere 13.8%, which is attributable to $100 million fixed costs per year.

- The formula can reveal how well a company uses its fixed-cost items, such as its warehouse, machinery, and equipment, to generate profits.

- Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

What is financial leverage?

It is important to understand that controlling fixed costs can lead to a higher DOL because they are independent of sales volume. The percentage change in profits as a result of changes in the sales volume is higher than the percentage change in sales. This means that a change of 2% is sales can generate a change greater of 2% in operating profits. If a firm generates a high gross margin, it also generates a high DOL ratio and can make more money from incremental revenues. This happens because firms with high degree of operating leverage (DOL) do not increase costs proportionally to their sales. On the other hand, a high DOL incurs a higher forecasting risk because even a small forecasting error in sales may lead to large miscalculations of the cash flow projections.

Common examples of industries recognized for their high and low degree of operating leverage (DOL) are described in the chart below. A second approach to calculating DOL involves dividing the % contribution margin by the % operating margin. The DOL would be 2.0x, which implies that if revenue were to increase by 5.0%, operating income is anticipated to increase by 10.0%.

Instead, the decisive factor of whether a company should pursue a high or low degree of operating leverage (DOL) structure comes down to the risk tolerance of the investor or operator. Next, if the case toggle is set to “Upside”, we can see that revenue is growing 10% each year and from Year 1 to Year 5, and the company’s operating margin expands from 40.0% to 55.8%. Just like the 1st example we had for a company with high DOL, we can see the benefits of DOL from the margin expansion of 15.8% throughout the forecast period.

If you have the percentual change (period to period) of sales, put it here. Otherwise, add the specific period data in the section “Period to period specific data” above. We put this example on purpose because it shows us the worst and most confusing scenario for the operating leverage ratio. Regardless of sales levels, the company must spend a certain amount to continue operating.